Ok, you see a nice trade opportunity. And you know where to place your stop loss. Now, how about the take profit order? Where do you place it?

In this post, I will show you my approach to setting my initial take profit levels.

Table of Contents

- What is a take-profit order?

- Finding good take profit levels

- Differences in setting take profit orders for different securities?

This initial take profit level is not where I will necessarily get out at a profit. However, it is there to help me gauge the trade’s potential, so I can decide if it is worth taking the risk.

The basic rule I follow when trading is:

First, determine the risk in a potential trade. The profits will follow.

So after I have assessed the maximum risk I would be taking on if I would enter a trade, I then see if there is enough profit potential compared to the risk. I have explained this concept in-depth in my post: What is R in Trading? And why is it so important to understand? You might want to read that post first if you are not familiar with the concept of R in trading.

What is a take-profit order?

So, before we continue, let’s take a step back and first define what a take-profit order actually is.

A take-profit order is an automated order at your broker or exchange that will sell your open long position or buy back your open short position for a profit once the price hits your predefined level.

Mental take profit

Some traders use mental take profit orders. This means they will execute the buy or sell order when they see the price hit their predefined level. So they do not have an order placed at their broker or exchange.

I do not use metal take profit orders for two reasons:

- I do not watch the markets the whole day, so I can miss my level being hit. Then when I take a look at the market at the end of the day, the price may have retraced a lot already and I missed the right exit opportunity.

- When the price moves in my favor and I am in profit, I can get greedy. When this happens I stay in the trade and more often than not, the price starts to move against my position. So for me, it is better to be taken out of the trade automatically. So the decision to get out of a trade is made before I even get in.

Finding good take profit levels

So how do you know what levels are the best level to take profits? So, for exiting a trade that is going against me I want the market to show me that my initial reason for entering is no longer valid. Now, for exiting in profit, I use the same kind of reasoning.

I want to get out of a winning position at a level where there is a high probability that the trade will reverse.

These levels can be found by looking at:

- Horizontal support and resistance levels

- Diagonal support and resistance levels

- Dynamic support and resistance levels

- Fibonacci levels

- Ichimoku based levels

And these levels can differ depending on the type of market we are in. I will show you how I determine where I place my take profit orders for trades in the following market conditions:

- trending markets trading with the trend

- trending markets trading counter-trend

- sideways markets

No matter what the market conditions are, there is one thing to keep in mind when looking for potential profit levels and that is:

Look left; the markets leaves clues!

Finding good take profit levels in trending markets trading with the trend

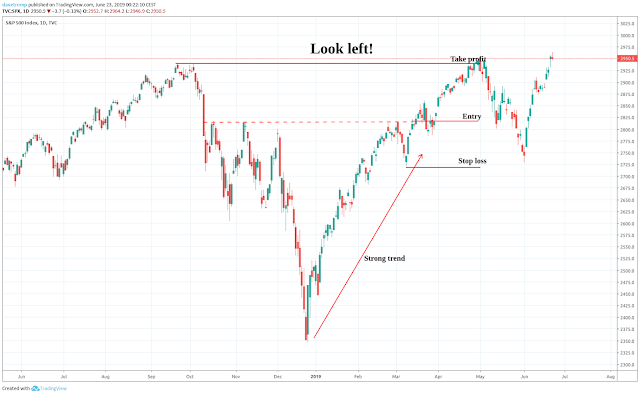

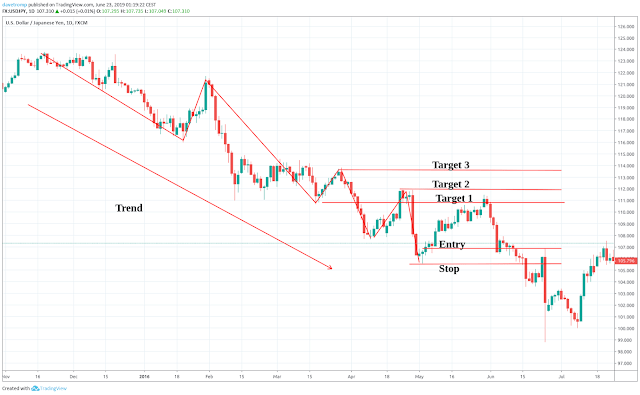

The above chart shows the OHLC prices over time for the S&P500. Let’s just see that I have spotted an entry and stop level as marked on the chart. All I have to do is look left and see if there are some obvious previous levels where the price reversed. Here on this chart, it was a very clear level. I usually place my take-profit order a bit before, in this case below, the level I found on the left.

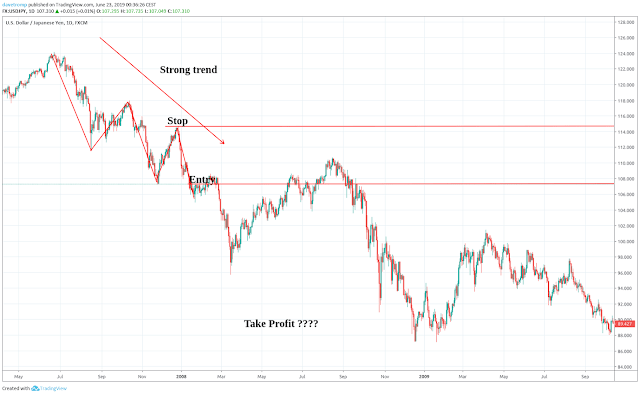

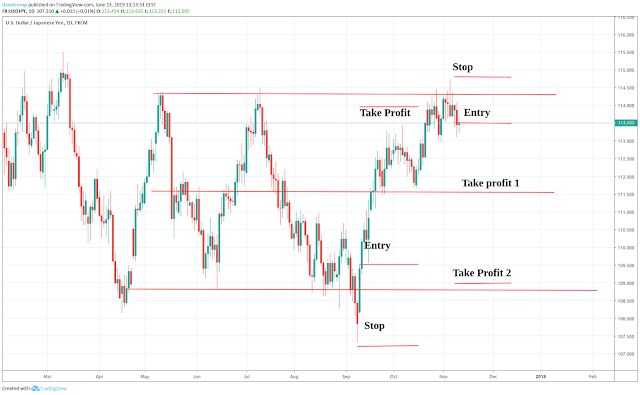

This example was very obvious, but sometimes it is not so obvious and we might have to scroll a lot to the left and zoom out to find relevant levels. Let’s look at the below chart for the USDJPY.

So where could you place your take profit in this case? If we look left there is nothing to see, … yet. So what do we do? Right. We zoom out and scroll back.

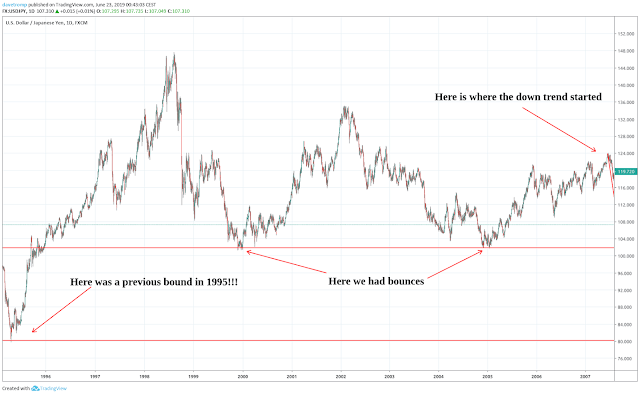

Here is the same chart, but then zoomed out and scrolled back to 1995. Looking left we see two levels where price obviously bounced. Now let’s go back to our trade on the chart.

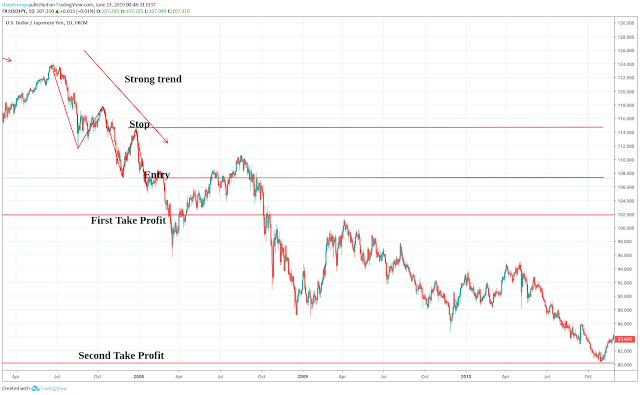

Now we see that the first take profit level is located relatively nearby and that the second possible take profit level is a long way down. Based on this we can plan our trade or decide not to take this particular trade. One way to trade with these take-profit levels is to split up your entry order into two parts. One order will target the first take profit level and the other will target the second take profit level. In this case, both targets would have been hit, but you would have had some days with a drawdown.

Finding good take profit levels in trending markets trading counter-trend

Trading counter-trend, usually means I am more conservative with the estimation of the take profit levels. Most of the time the first take profit level is the best level to target, while the second or third levels will not be reached as price tends to continue with the trend before it gets to these levels. In the below chart I have identified three horizontal levels.

As you can see price only retraced to target 1 before continuing on lower. So If the first target level is enough to make a good return I would use that as my take profit target. However, if a trend has been going on for some time, the retraces can be deeper. It takes some experience trading a particular market to understand if there is a higher potential for a deeper retrace, so if you are just starting to trade or just started to trade a new market, then I suggest you go for the first target only when trading counter-trend.

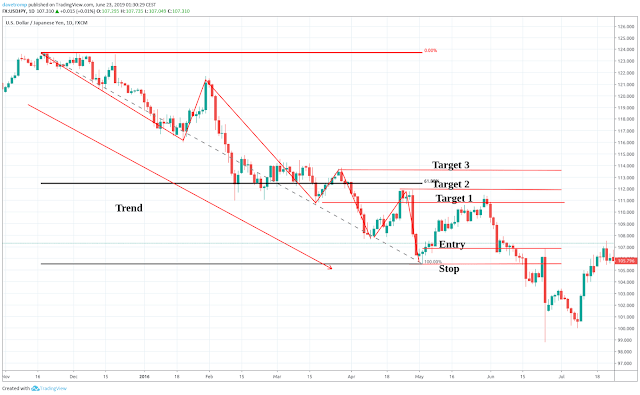

The next chart shows the 61.8% Fibonacci level. In trends, price tends to retrace to the Fibonacci levels and particularly to the 61.8% level. I use it as yet another indication of where price might retrace to before continuing the trend. As you can see, in this example the price did not reach the Fibonacci level.

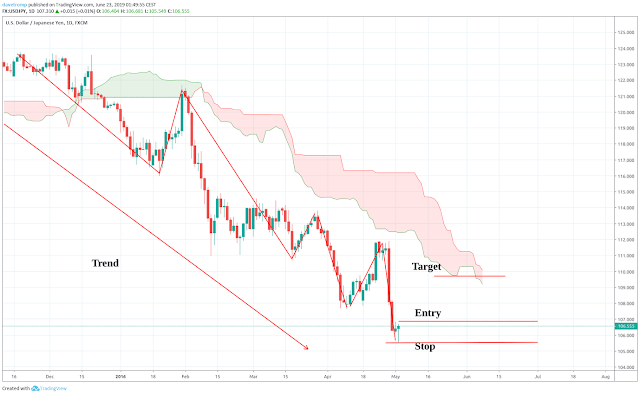

I also often use the Ichimoku Kinkho Hyo indicator to find good levels where the price might turn. The Ichimoku cloud is a very versatile indicator and I won’t go into details about it now, but here is one trick I use to find my take profit area in a counter-trend trade.

The trick is actually very simple. I place my take profit order at the bottom of the future Kumo or cloud. It is important to note that I mention the future cloud. As you can see, at the time of the entry the cloud above the entry point is much higher than the lowest point of the cloud in the future. So target the lower level. If you want to learn more about the Ichimoku Cloud, then go to the Start Here page where I link to resources that should help you on your way.

Finding good take profit levels in sideways markets

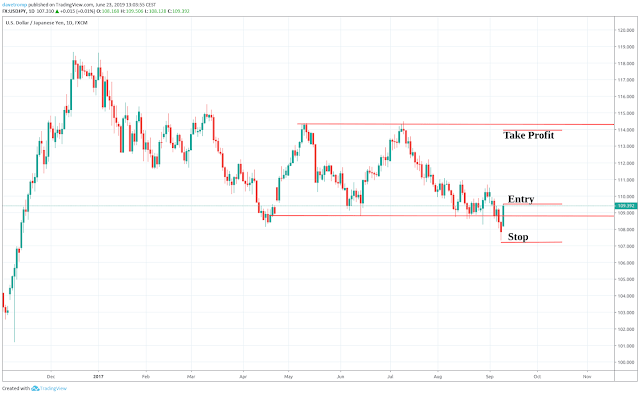

In sideways markets, your profit targets will be defined by the range that the market is in. What you want to do, is, exit your position right before the price hits the other side of the range. Let’s have a look at the below chart.

As you can see we get out before the top of the range would be hit. We do this because at this level it is likely the price will reverse again. Of course, the price could also break out of the range, but we can take that as a separate trade if that does happen. The below chart shows what happened and how we could have placed another trade.

So, our take profit target would have been hit and we could turn around and trade short.

A more conservative target is to target the middle of the range instead of the other side of the range. If I can get a good enough R, then I will target the middle of the range rather than the other side of the range. This will improve the win rate in exchange for leaving some R on the table on some of the trades.

Also, if the price has been moving in a range for some time, I become more cautious and will only target the middle of the range, or sometimes even less if this still gives me a good return.

If you want to know more about the win rate and R, then I have a post explaining all this right here.

Differences in setting take profit orders for different securities?

Different types of securities require slightly different approaches to placing take profit orders. The above explanations are applicable to all markets

Let’s have a look things we have to take into consideration when placing take profit orders on:

- Forex

- Bitcoin and other cryptocurrencies

- Precious metals

- Stocks and ETFs

Where to place your take profit order in Forex

|

| Trading Fiat Currencies or Forex |

When I am in a Forex trade, then I always consider the following when planning my exits, being it for a loss or a profit:

- Overnight fees

Forex trading is mostly leveraged trading. This means you are borrowing money from your broker to trade a larger position. Depending on the interest rates on the currencies in the pairs you trade, you will have to pay a fee to keep a position open overnight. Especially, if you trade more exotic pairs like the EURTRY, for instance, the fees can add up significantly. For example, if you would go long the EURTRY right now, you would pay 24% every year to keep this position open. So you kinda wanna keep these kinds of trades short and sweet. If your profit target is almost hit and it looks like it will still take a few days before it will be hit, then consider closing that trade a bit earlier. - Weekend gaps

Forex markets are closed during the weekend. Forex is a 24/5 market. So if on Friday your target is almost hit, you might want to manually close out your trade for a profit, because who knows what will happen during the weekend.

Where to place your take profit in Bitcoin and cryptocurrencies

|

| Trading Bitcoin and Cryptocurrencies |

Bitcoin and cryptocurrencies can be traded 24/7, so there are no weekend gaps. Still, the liquidity and trade volume is lower during the weekend. You might have some difficulty getting good fills during the weekend and the spread may be larger, but you can trade.

If you trade through a broker they may offer you some leverage of 1:2. In this case, you will pay overnight fees. If you do not use leverage to trade at an exchange or broker, you will not pay overnight fees and do not have to consider them.

There are three factors that I do consider when thinking about my trade exits and these are:

- Volatility

The cryptocurrency markets are still small and extremely inefficient. This makes them very volatile. Prices can make big moves up or down per day. - Parabolic moves

The price of Bitcoin and other cryptocurrencies can sometimes go up or down in an almost straight vertical line. These are so-called parabolic moves. Parabolic moves up are often followed by crashes down. - FOMO

FOMO is the Fear Of Missing Out. Many people that buy or trade cryptocurrencies are novice traders. Seasoned traders try to buy low and sell high. However, most cryptocurrencies are bought by beginners, just because the price went up a lot. So in the crypto space, there are a lot of beginners still, that keep buying ever-expensive coins, because they fear they will miss out on the opportunity. This means prices can keep rising for longer then logic would dictate. - FUDFUD is the opposite of FOMO. It stands for Fear Uncertainty and Doubt. FUD is when all newbies lose complete faith and start dumping all of their holdings at ANY price. This will push prices to extreme lows, which also defies any logic.

Where to place your take profit in stocks and ETFs

|

| Trading Stocks and ETFs |

If you are trading stocks and ETFs without leverage and you are not shorting, then there are no overnight fees to pay. Still, you will always have to consider:

- Overnight gaps

Differences between yesterday’s closing price and today’s opening price can be huge. This can be caused by aftermarket hours news events. This is can be news of a CEO stepping down for stocks, or an economic news release that affects an index ETF. Economic news releases are scheduled, so if you know an impactful release is coming, then you might want to start taking some profits before that. - Weekend gaps

This is the same as for the weekend gaps in Forex. A lot can happen in one weekend, so if you are close to your target, you may consider selling a little bit early.

So, I hope you have gotten a clearer idea of how to place profit targets in different market types and for different kinds of securities.